I’M Shawn

Licensed Broker & Senior Field Underwriter

It's not about how much life insurance you need. It's about how much life insurance your family or loved ones need when you're not here.

I’M Shawn

Licensed Broker & Senior Field Underwriter

It's not about how much life insurance you need. It's about how much life insurance your family or loved ones need when you're not here.

Over 1 Million

Families Helped

$150 Billion

Life Insurance Placed

$800 Million

Premium Sold

10,000+

Professional Agents

Over 1 Million

Families Helped

$150 Billion

Life Insurance Placed

$800 Million

Premium Sold

10,000+

Professional Agents

Final Expense

Final Expense insurance will cover you for life. Prices are locked and will never increase nor will your policy end. These types of policies are designed to make sure all funeral and other end of life expenses are covered.

Mortgage Protection

Mortgage protection insurance is a way to protect one of your most valuable assets in the event of a death. Most terms are designed to give you a full return of premium if you outlive the policy. In the event of a death, the mortgage will be paid in full, so your family can keep the house.

Indexed Universal Life

This is a type of permanent policy that allows the insured to accumulate cash value in addition to their death benefit. It can be setup to help supplement your retirement plan.

Fixed Indexed Annuities

This is a safe way to participate in the market's gains while avoiding potential loses and keeping your retirement secure.

Industry's Best Insurance Providers

About Me

Hello, my name is Shawn Leonard and I have been a licensed independent insurance broker since 2016. I represent most major A-rated insurance companies for Mortgage Protection, Final Expense, Indexed Universal Life, Guaranteed Life insurance, Child Life insurance, Cancer, Heart Attack, and Stroke coverage, Accidental Death, Dental coverage, Medicare Supplement, and Medicare Advantage. Due to the wide range of carriers and coverages I offer, I have something for everyone.

My mission is to ensure everyone I meet has the protection and living benefits needed while adjusting to a new way of life if they become sick, disabled, or die. I also want to ensure that families can mourn with dignity and not have to worry about how they will pay for a funeral or cremation, that they won't have the added stress of wondering how they will pay the mortgage or rent and utilities when they or a loved one dies. I have been in this situation both with insurance for my loved ones and without insurance. I became a widow at the age of 28 with 3 young children and there was no life insurance for my late husband. The stress was almost unbearable having to move in with family as I could no longer afford all of the expenses alone. I vowed at that time to never be without life insurance again! I had a 20 year career in the health field working in ICU where families were not only devastated by the loss of a loved one but the loss of financial security. So, in 2016, I decided to learn more on how insurance worked as my current husband was diagnosed with cancer and could no longer work thus losing his health and life insurance benefits with his employer leaving us without coverage. I didn't know at the time that I would be compelled to become an insurance professional but here I am today! I love helping people so insurance is a great fit for my personality.

I am here to help you and your family put a plan in place so you have the health and life coverages you need; coverage to help get you through times of critical, chronic, and terminal illnesses.

I am the one to ensure that on the worst day of your life, when you lose a loved one, and on the worst day of your family's life, when you die, they will not have to worry about paying the bills next month. They can focus on grieving and healing.

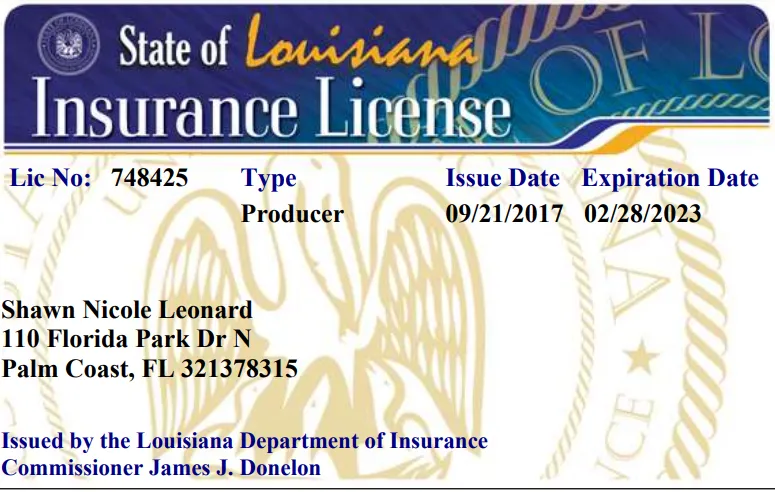

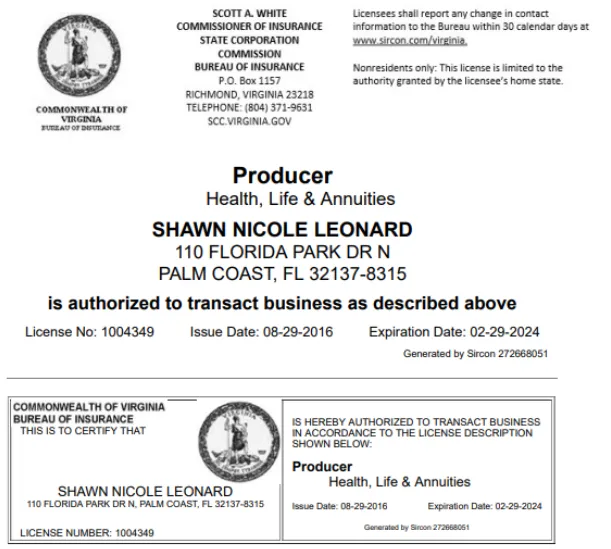

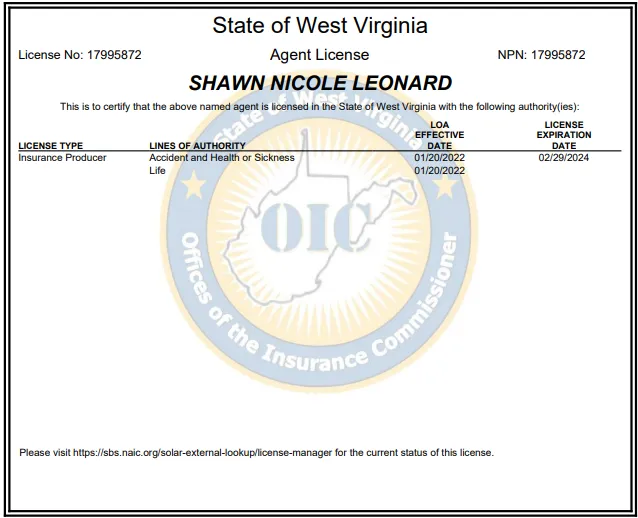

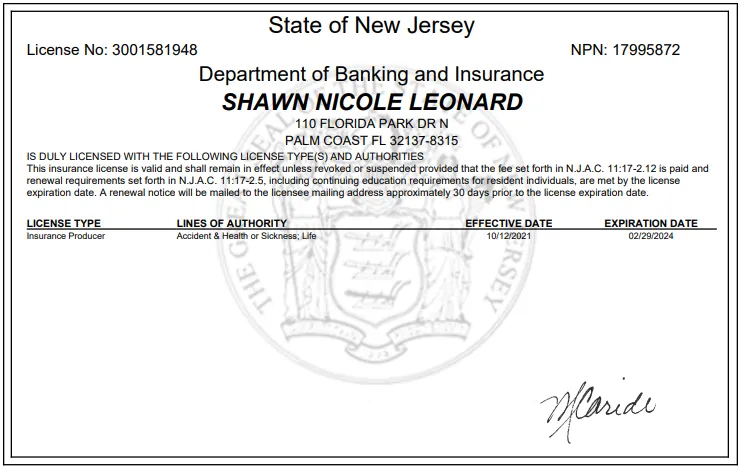

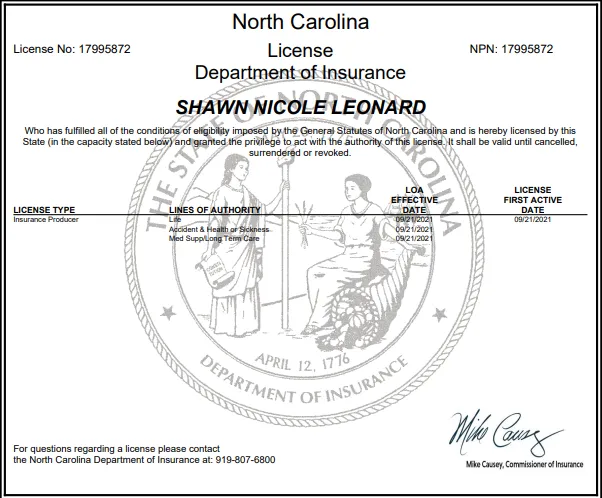

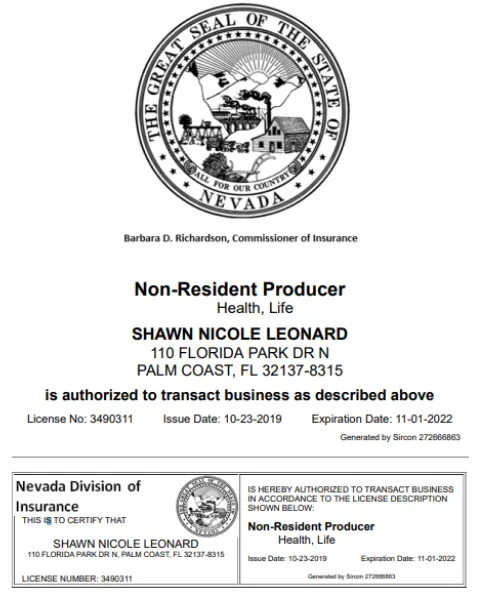

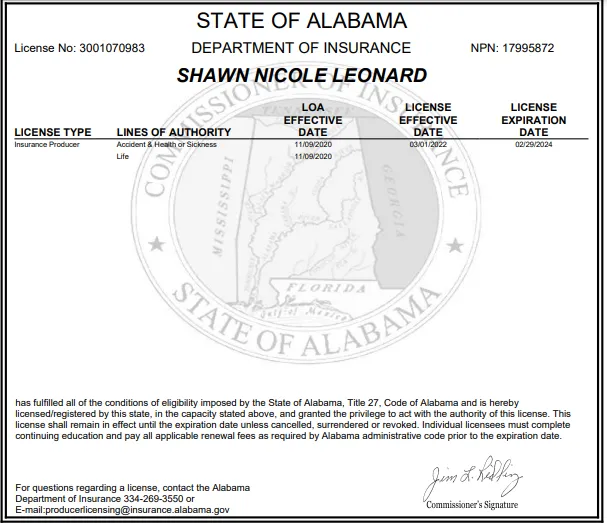

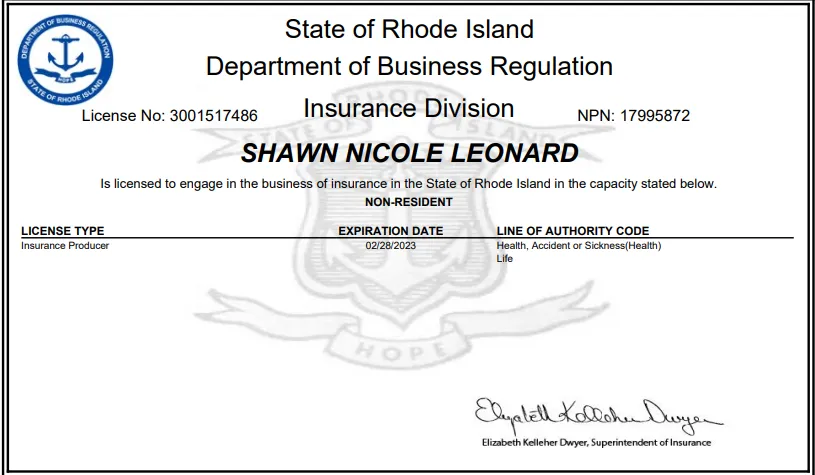

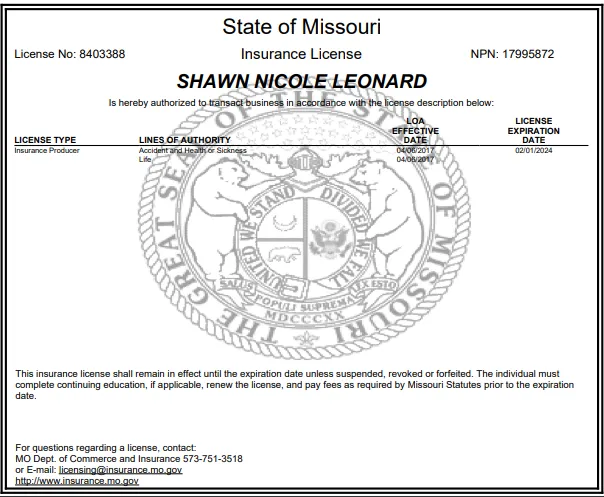

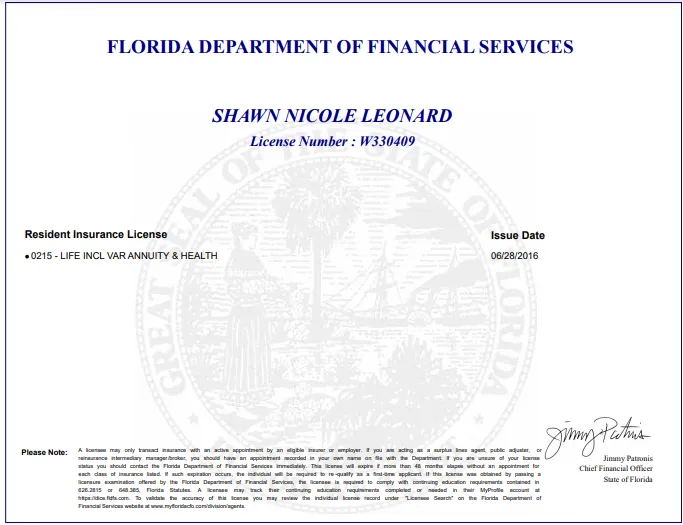

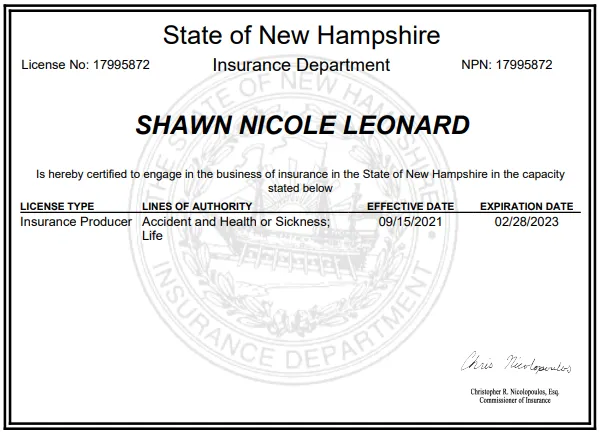

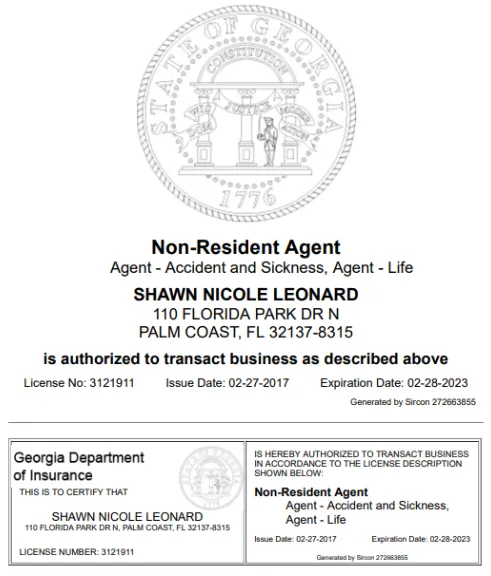

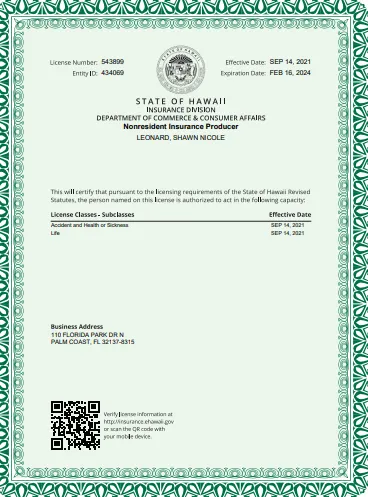

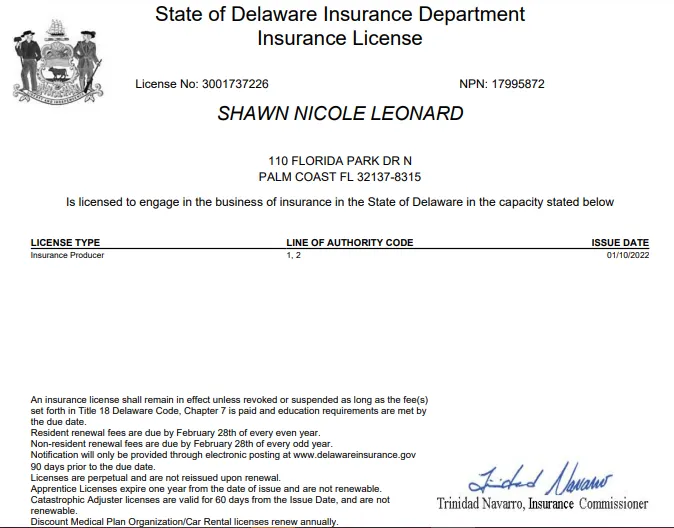

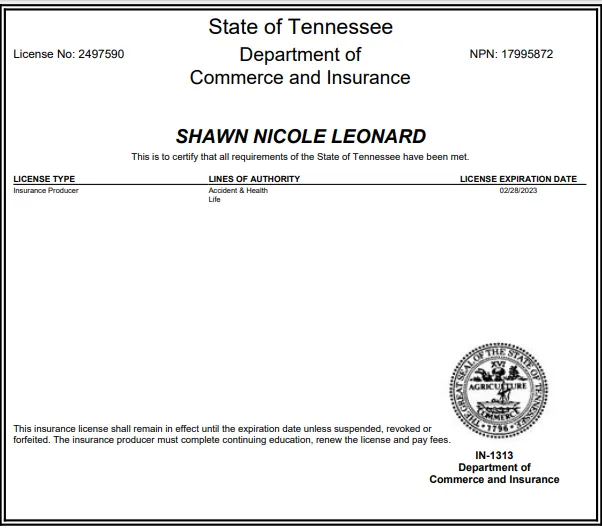

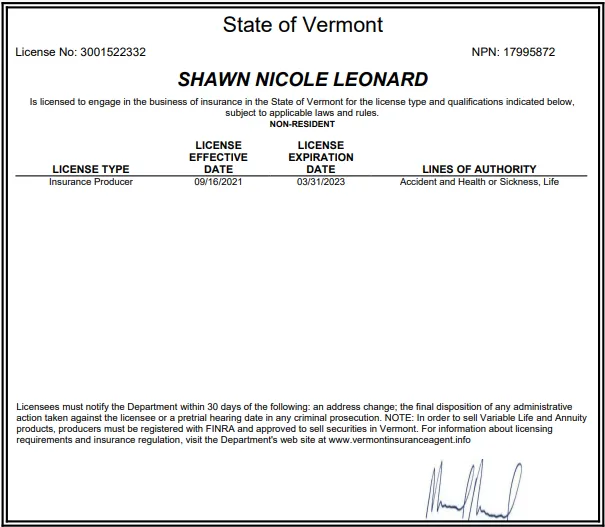

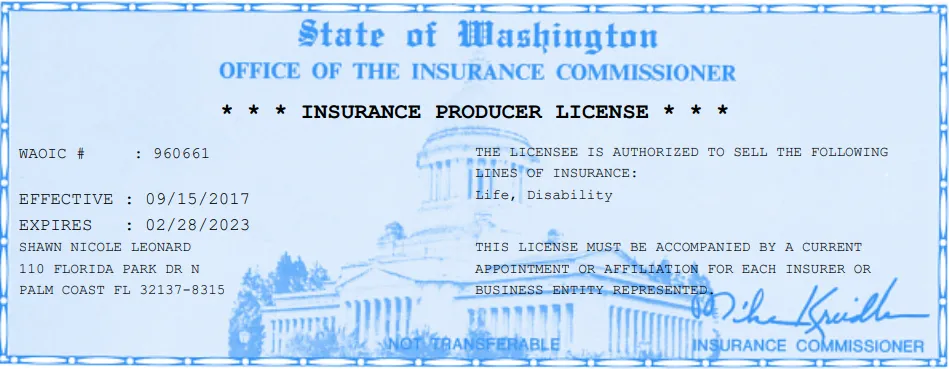

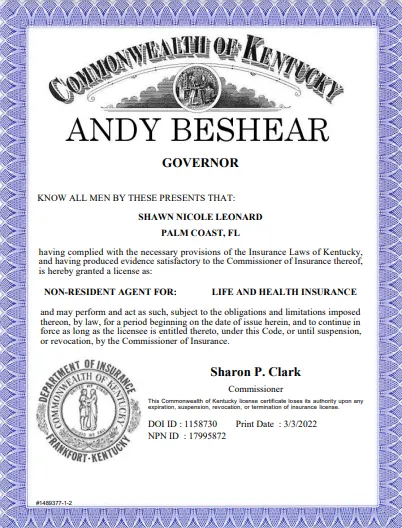

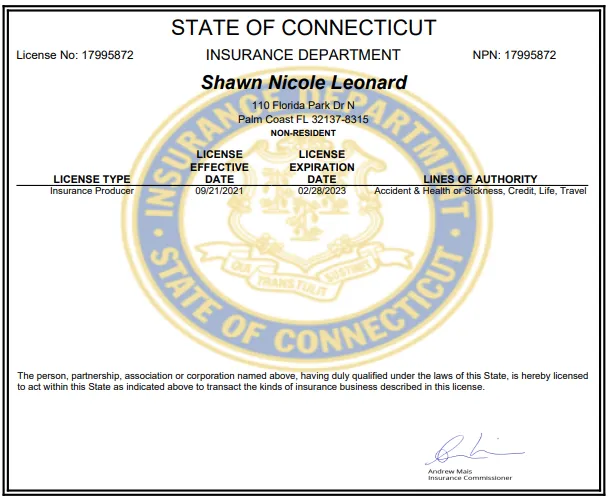

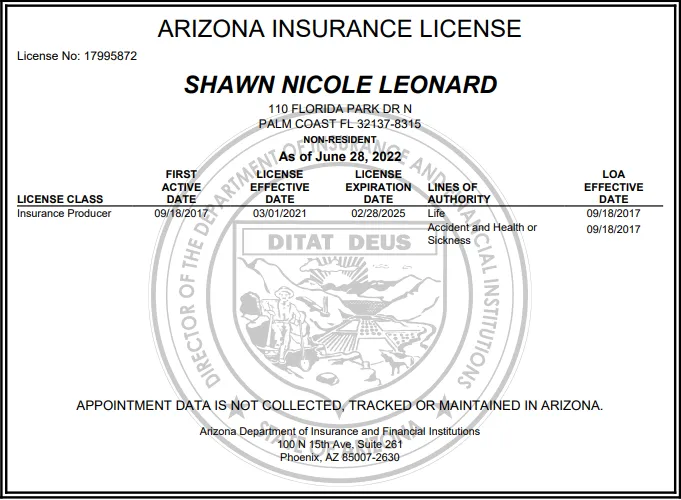

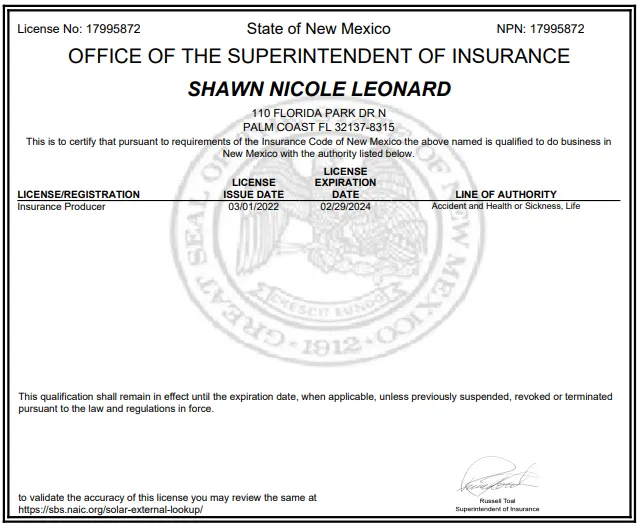

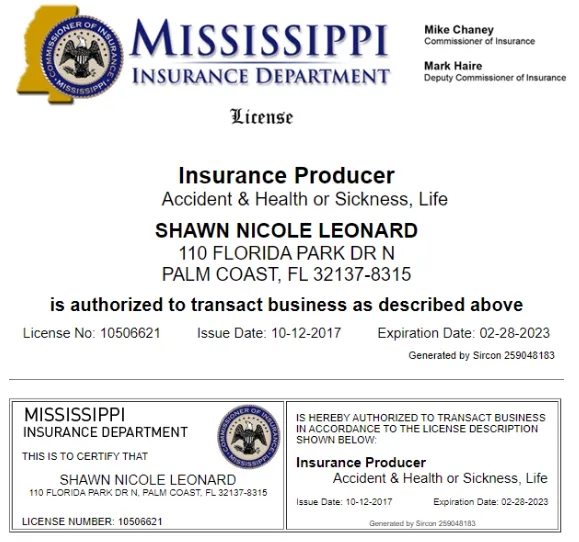

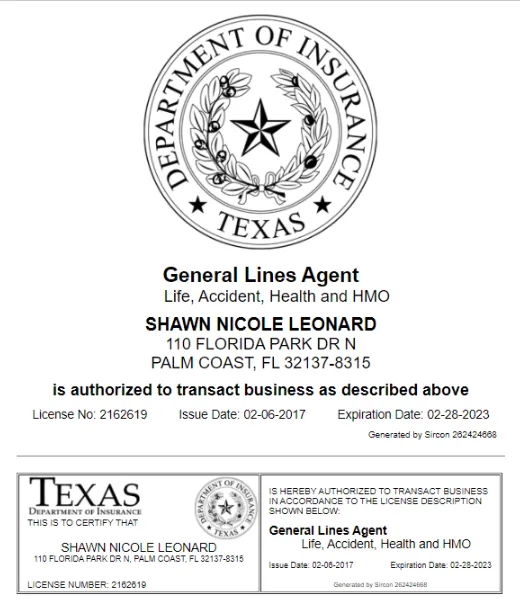

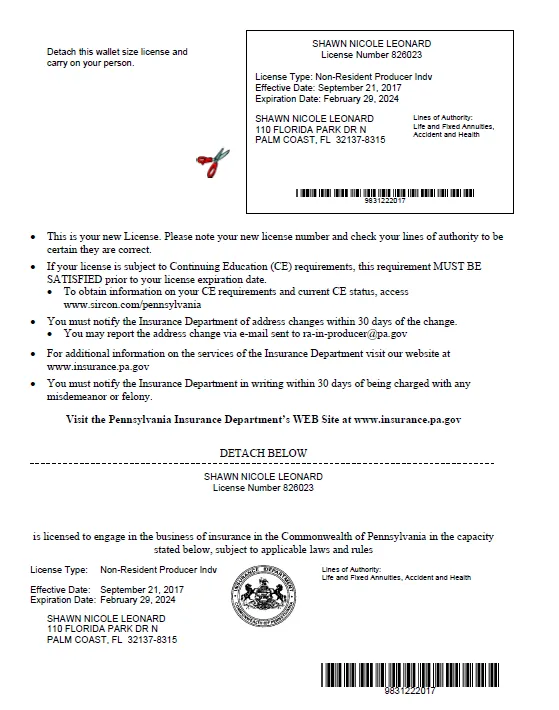

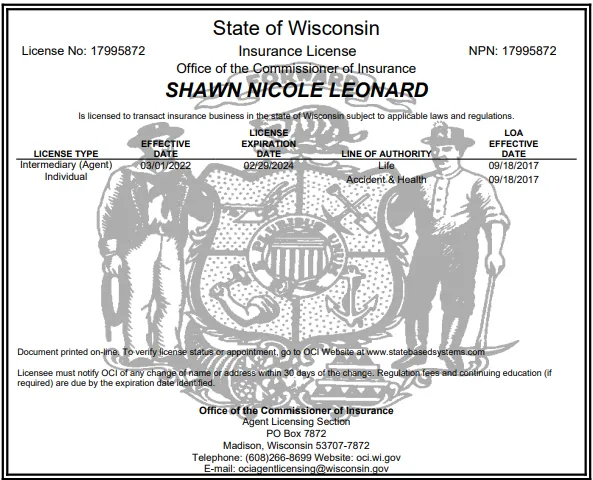

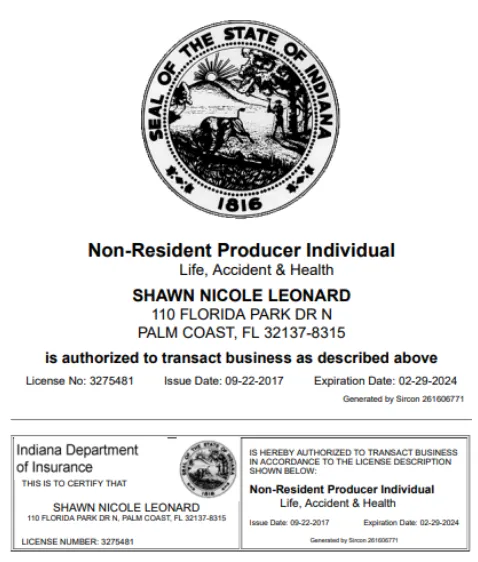

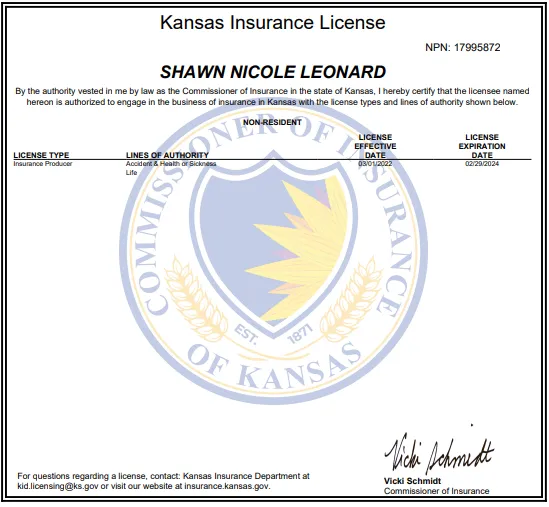

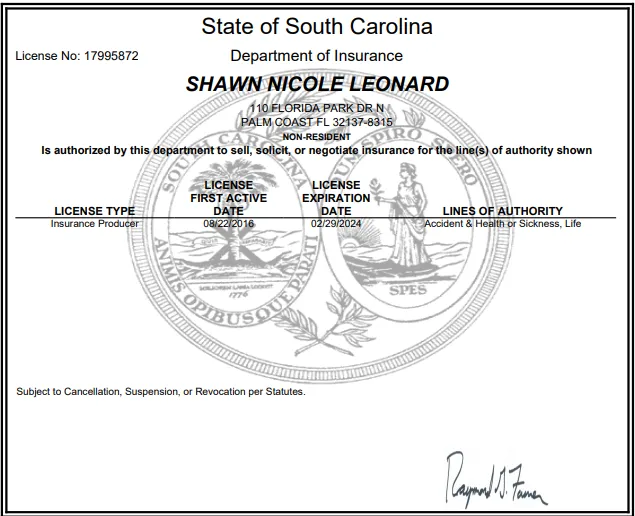

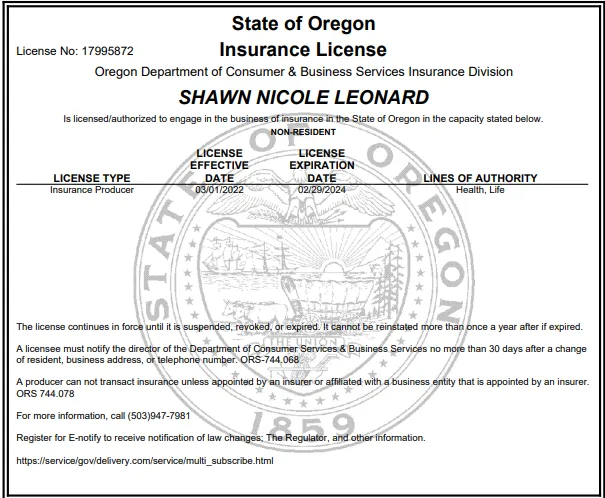

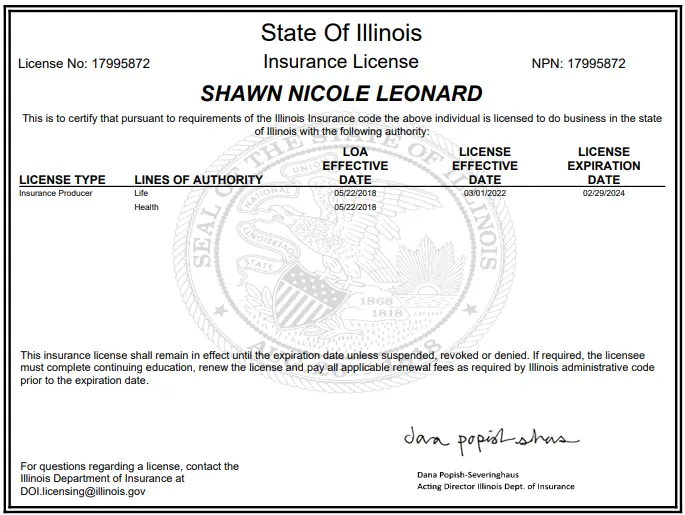

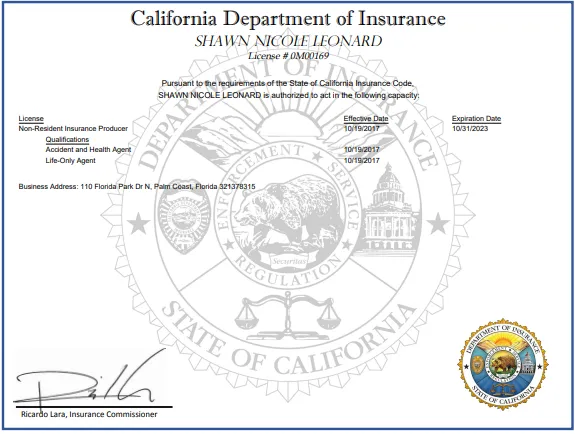

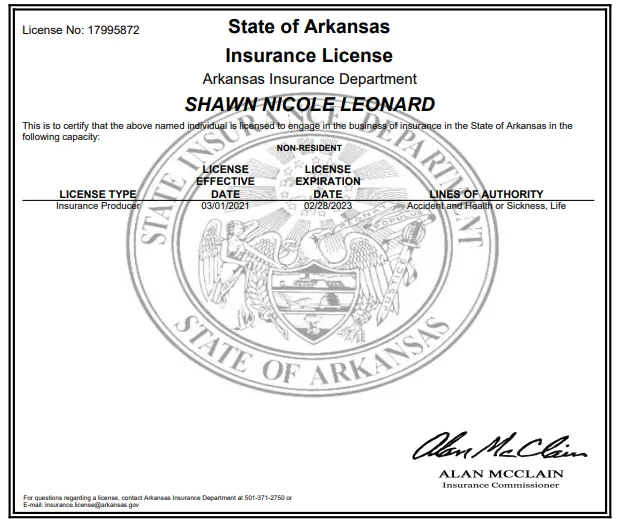

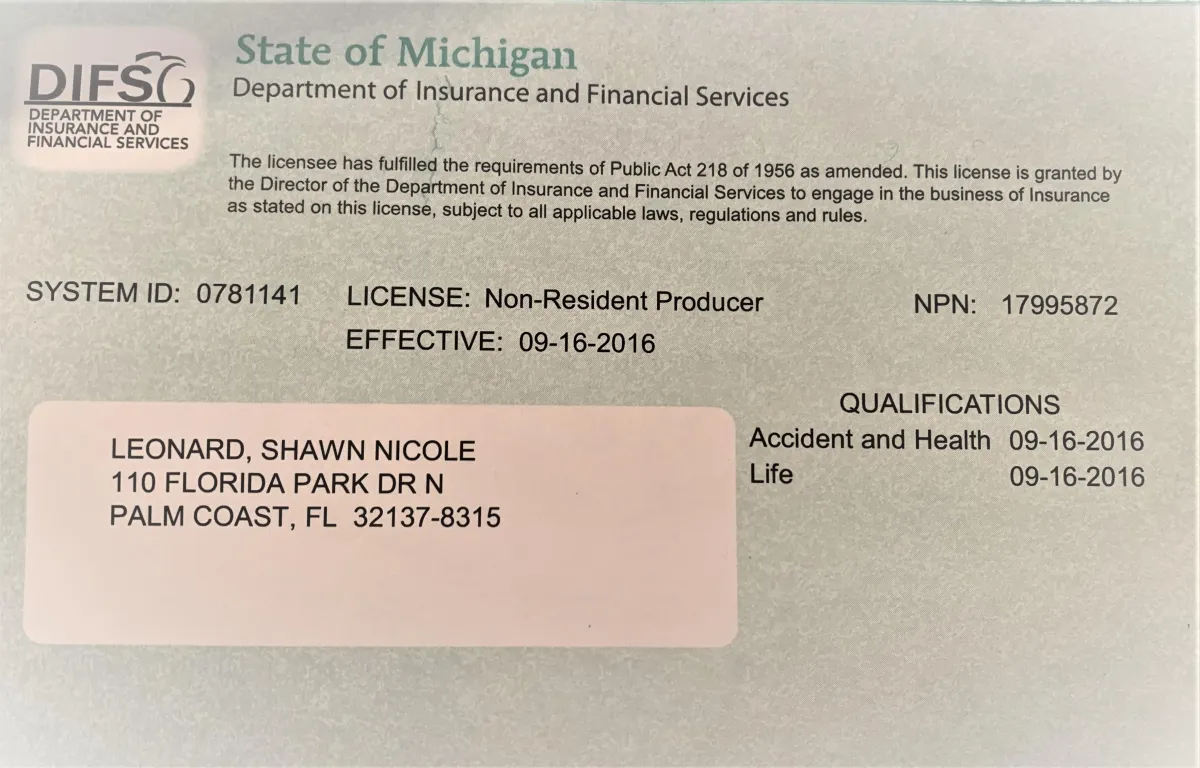

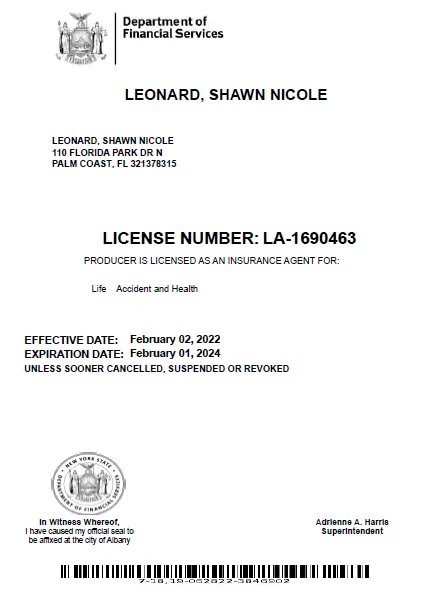

Licenses & Credentials

National Producer #: 17995872

Copyright ©2022 All rights reserved